arizona solar tax credit 2019

Currently the credit amount is as follows. Ad Calculate Your Cost To Go Solar.

Here S Why Winds Have Been So Strong La Nina And Friends

Arizona is a leading state in the national solar power and renewable energy initiative.

. Check Solar Incentives Compare Quotes. Filed by individuals corporations and partnerships to claim the Renewable Energy Production Tax Credit. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

Arizona Residential Solar and Wind Energy Systems Tax Credit. Ad Top Solar Power Companies In Your Area. Renewable Energy Production Tax Credit.

The credit is allowed against the. Arizona Department of Revenue. 41-1511 was established by the Arizona.

1 Best answer. Solar Federal Tax Credit. Check Rebates Incentives.

There is no maximum amount that can be. See details about the federal personal tax credit here. But in order to qualify for that.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. The credit amount allowed against the taxpayers personal income tax is. A Comparison List Of Top Solar Power Companies Side By Side.

Individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona. Check Solar Incentives Compare Quotes. Installation of the PV system must have been between January 1 2006 and December 31 2019.

An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. Enter Zip - Get Qualified Instantly. Arizonas State and Local Solar Incentives and Rebates.

This incentive is an Arizona personal tax credit. Get Qualified in Minutes. Arizona Renewable and Solar Energy Incentives.

The Federal solar tax credit allows homeowners to reduce 26 of the total costs related to their solar installation from what they owe on their federal taxes due. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. That means that for solar electric systems put into service between Jan 1 2009 and Dec 31 2019 you will be able to get back 30 of the total cost of the system with no cap for.

Check Rebates Incentives. 23 rows Did you install solar panels on your house. To claim this credit you must also.

The federal Energy Policy Act of 2005 established a 30 tax credit up to 2000 for the purchase and installation of residential solar electric and solar water heating property and a 30 tax. Check Our Easy-To-Read Rankings. 6 The maximum credit in.

1000 Arizona Solar Tax Credit At the state level in Arizona not only is there is no sales tax charged but you can receive a state income tax credit of up to 1000 for a solar purchase. Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. This is claimed on Arizona Form 310 Credit for Solar Energy Devices.

Get Qualified in Minutes. Find The Best Option. Arizona solar tax credit.

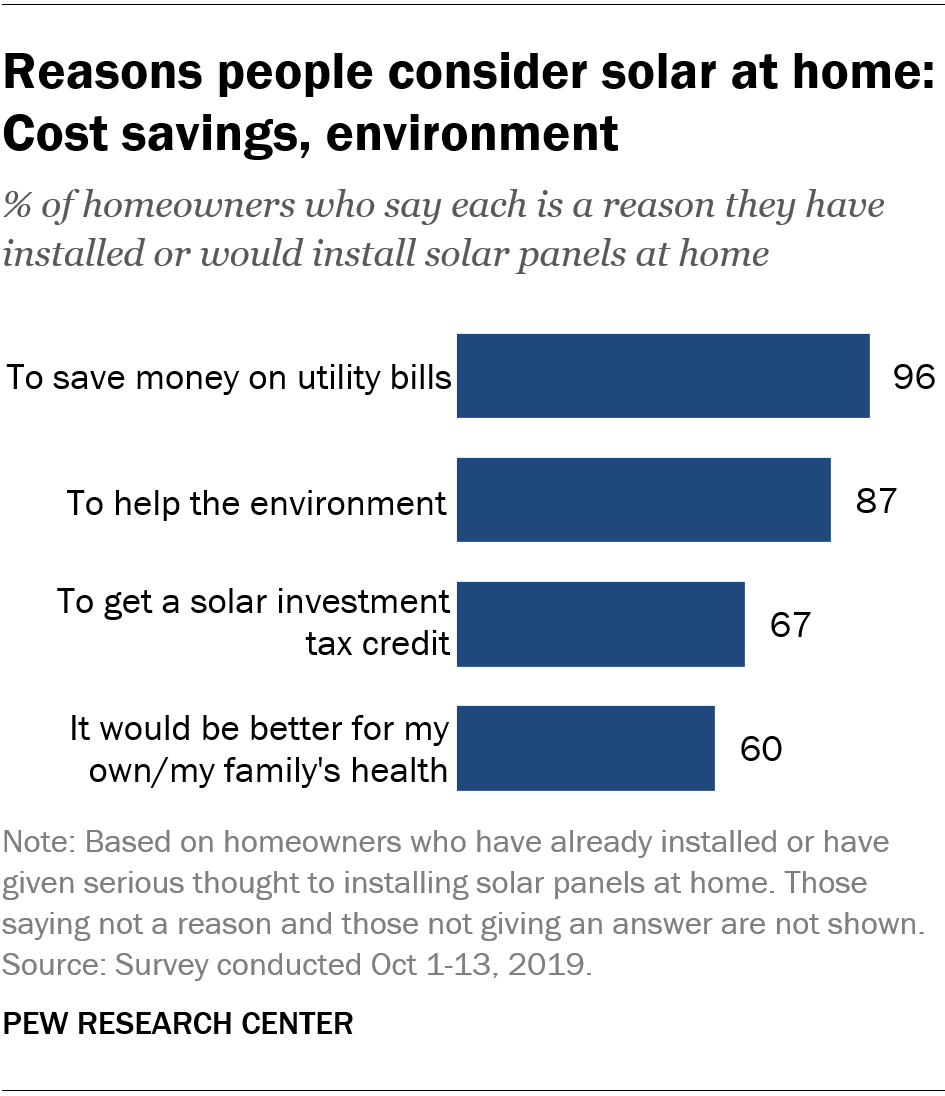

Favorable laws rebates property and sales tax. According to recent data a 5 kilowatts kW solar installation in Arizona averages between 12495 and 16905 in cost with an average gross price of 14700. For people interested in saving money and diminishing their carbon footprint installing solar panels are now a much more affordable and realistic option.

30 for systems placed in service by 12312019 Expired 26 for systems placed in service after 12312019 and before. The Renewable Energy tax credit ARS. Since 1995 the state of Arizona has offered.

June 6 2019 1029 AM. There are several small- and large-scale solar incentives available for Arizona residents including city-specific. This tax credit is good through 2022.

Enter Zip - Get Qualified Instantly. Renewable Energy Production Tax Credit. Individuals in Arizona receive a tax credit for 25 of.

Arizona Personal Tax Credit. The Renewable Energy Tax Incentive Program is not available beginning on or after January 1 2021. Ad Calculate Your Cost To Go Solar.

Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

Universo Magico La Galaxia Del Triangulo Space And Astronomy Earth From Space Space Pictures

How Does Your State Make Electricity The New York Times

Eia Annual Energy Outlook 2020 Issue In Focus U S Energy Information Administration Eia

The Extended 26 Solar Tax Credit Critical Factors To Know

Where And When To See The May 20 Solar Eclipse Eclipse Photos Solar Eclipses Solar Eclipse

More U S Homeowners Say They Are Considering Home Solar Panels Pew Research Center

Fun Free Things To Do Near Me With Kids Archives United States Map Usa Map Territories Of The United States

Asteroid Bennu S Features To Be Named After Mythical Birds Osiris Rex Mission Mythical Birds Solar System Images Nasa

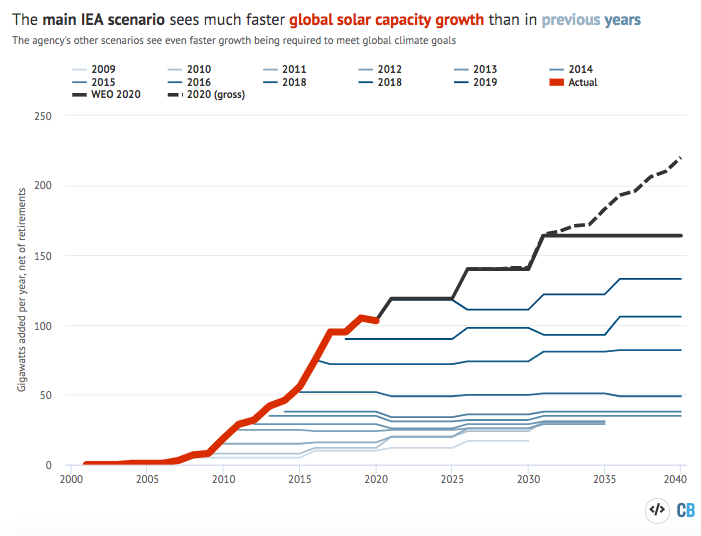

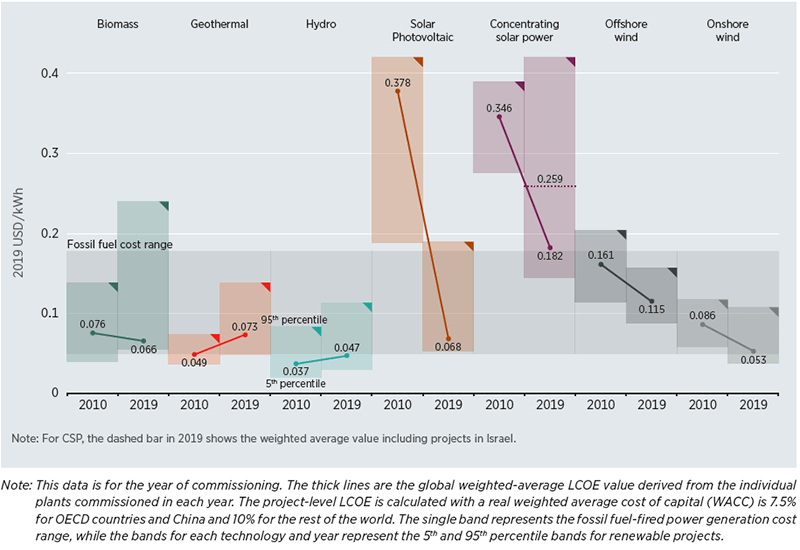

Solar Is Now Cheapest Electricity In History Confirms Iea

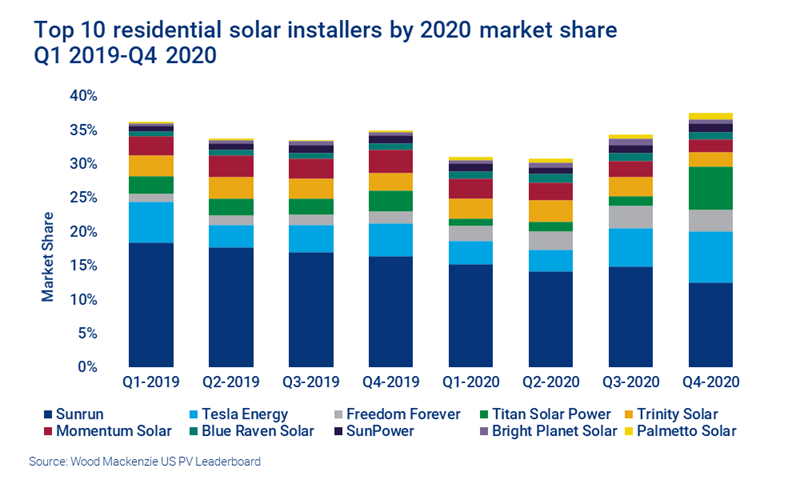

Us Solar Hits Some Bumps In The Road Wood Mackenzie

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

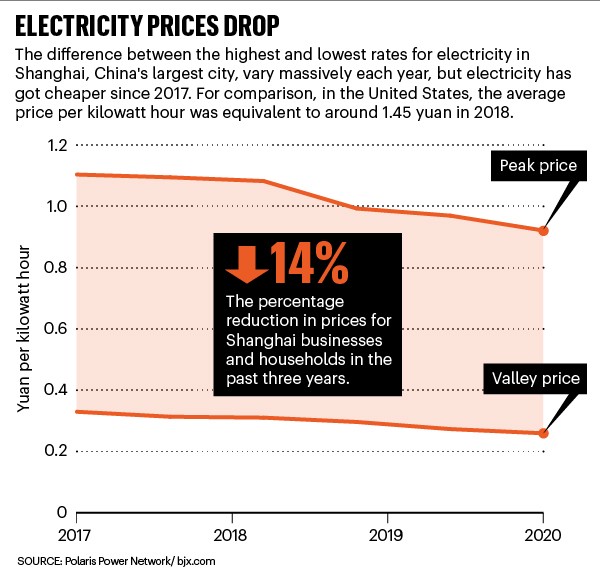

China S Plan To Cut Coal And Boost Green Growth

Solar Is Now Cheapest Electricity In History Confirms Iea

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Business Insider S 15 Facts About The Coming Water Crisis Water Scarcity Water Crisis Water Poverty

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

Energy Design Rating Energy Consulting Energy Energy Services